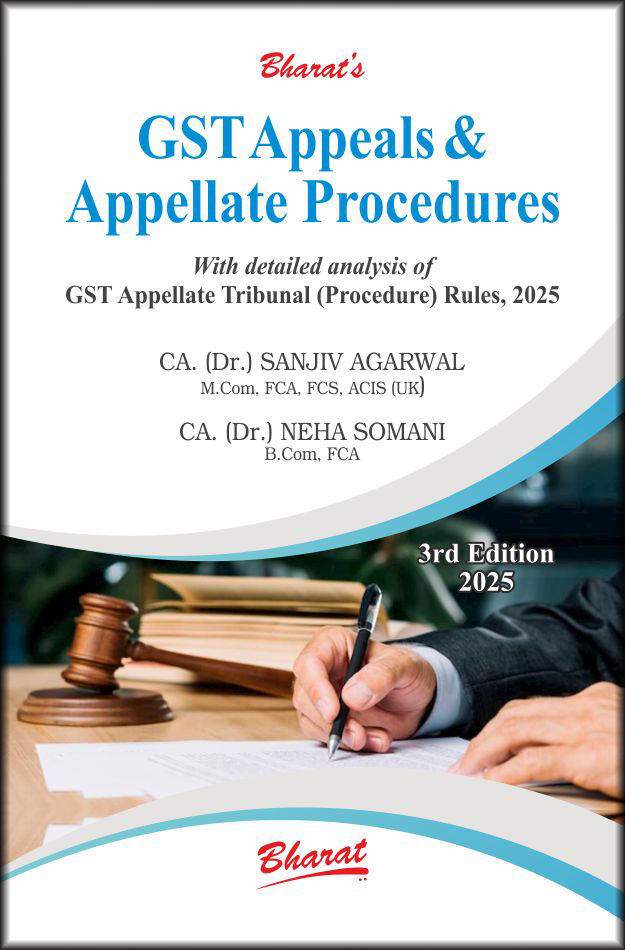

GST Appeals & Appellate Procedures by CA. (Dr.) SANJIV AGARWAL CA. NEHA SOMANI, 3rd Edition 2025 Rs. 1995/-

About GST Appeals & Appellate Procedures

GST in India & Overview

Appeals and Revision: Legal Framework

Legal Terminology and Principles of Interpretation

Appeals to Appellate Authority

Text of Rules 26, 108, 109, 109A, 109C and 113 of Central Goods and Services Tax Rules, 2017 (CGST Rules, 2017)

Text of Forms GST APL-01, GST APL-02 GST APL-03, GST APL-04 and GST APL-01/03W of Central Goods and Services Tax Rules, 2017 (CGST Rules, 2017)

Text of Notification No. 2/2017-Central Tax, dated 19.06.2017 regarding jurisdiction of authorities and subsequent amendments upto 31.03.2025

Text of Kerala State Circular No. 5/2024, dated 6-4-2024 — Guidelines for numbering of Appellate Order

Text of Circular No. 157/13/2021-GST, dated 20-7-2021 — Clarification on extention of limitation period

Text of Notification No. 29/2023-CT, dated 31.07.2023 —Regarding special appeal procedure in transitional credit matters

Text of Notification No. 53/2023-CT, dated 02.11.2023 —Regarding Amnesty Scheme for GST Appeals

Text of Notification No. 22/2024-CT, dated 08.10.2024 — Special Procedure for rectification of orders

Text of Instruction F. No. 390/Misc/3/2019-JC, dated 05.11.2024 — Mandatory e-hearing in Indirect Taxes

Text of the Circular No. F. 3(640)/ GST/ P&R/2025/348-55, dated 13.06.2025 — Guidelines for Mandatory Conduct of Personal Hearings through Virtual Mode in UT of Delhi

Text of Circular No. 250/07/2025-GST dated 24.06.2025-Clarification on reviewing/revisional/appellate authority for orders issued by Common Adjudicating Authority

Appeals to Appellate Tribunal

Text of Rules 26, 110, 111, 112, 113 and 113A of Central Goods and Services Tax Rules, 2017 (CGST Rules, 2017)

Text of Applicable Forms GST APL-02, GST APL-04, GST APL-05, GST APL-06, GST APL-07 and GST-APL-05/07W of Central Goods and Services Tax Rules, 2017 (CGST Rules, 2017)

Text of CGST (Ninth Removal of Difficulty) Order No. 9, dated 03.12.2019

Text of Circular No. 132/2020-GST, dated 18.03.2020

Text of Circular No. 157/13/2021-GST, dated 20.07.2021

Text of Notification No. F.No. A-50050/150/2018-GSTAT-DOR, dated 14.09.2023 — Principal and State Benches of GST Appellate Tribunal notified

Text of Gazette Notification [F.No. A-50050/99/2018-Ad.1CCESTAT (Pt.)], dated 29.12.2023 — Constitution of Principal Bench of GSTAT

Text of Notification No. F.No. A-50050/ 150/2018-GSTAT-DOR, dated 31.07.2024 — Principal and State Benches of GST Appellate Tribunal notified

Text of Notification No. F.No. A-50050/ 99/2024-GSTAT-DOR, dated 26.11.2024 — Revised list of GSTAT benches with location

Goods and Services Tax Appellate Tribunal (Appointment and Conditions of Service of President and Members) Rules, 2023

Text of Notification No. GSR 256(E), dated 24.04.2025 — GSTAT Procedure Rules, 2025

Text of Circular F. No. A-50050/99/2018-CESTAT DOR-DOR, dated 15.02.2024 — Selection of Members for GSTAT

Text of Order No. 18/10/2024-EO (SM.II), dated 01.05.2024 — Appointment of President for GSTAT

Text of GSR 340(E), F. No. A-11/1/2024-CESTAT-DOR-DOR-Part (1), dated 21.06.2024 — Rules for GSTAT Employees

Text of Notification F. No. A-50050/99/ 2018-CESTAT-DOR-DOR, dated 28.07.2024 - GSTAT Authorities

Text of Circular No. 224/18/2024-GST, dated 11.07.2024 — Clarification on Recovery of GST dues in cases under Appeal

Text of Notification No. 18/2024-CT, dated 30.09.2024 — Appellate Authority for Anti-profiteering Cases

Text of Notification No. 19/2024-CT, dated 30.09.2024 — Anti-profiteering Authority not to accept cases under section 171 of CGST Act, 2017

Text of Circular No. 01/2024, dated 11.01.2024 issued by State GST — Kerala — Clarification on filing of Appeal before Appellate Tribunal

Revision of Orders

Text of Rules 109B of Central Goods and Services Tax Rules, 2017 (CGST Rules, 2017)

Text of Notification No. 05/2020-Central Tax, dated 13.01.2020

Text of FORM GST RVN-01 and Form GST APL-01 of Central Goods and Services Tax Rules, 2017 (CGST Rules, 2017)

Appeals before Courts

Text of Rules 26, 114 and 115 of Central Goods and Services Tax Rules, 2017 (CGST Rules, 2017)

Text of Form GST APL-04 and GST APL-08 of Central Goods and Services Tax Rules, 2017 (CGST Rules, 2017)

Text of Circular No. 207/1/2024-GST, dated 26.06.2024

Authorized Representative including GST Practitioner

Text of Rules 83, 83A, 83B, 84 and 116 of Central Goods and Services Tax Rules, 2017 (CGST Rules, 2017)

Text of Forms GST PCT-01, GST PCT-02, GST PCT-03, GST PCT-04, GST PCT-05, GST PCT-06 and GST PCT-07 of Central Goods and Services Tax Rules, 2017 (CGST Rules, 2017)

Miscellaneous Provisions Applicable to Appeals

Text of Notification No. 13/2017-Central Tax, dated 28.06.2017

Amnesty/Waiver Scheme under Section 128A

Text of Rule 164 of CGST Rules, 2017

Notification No. 21/2024-CT, dated 08.10.2024

Applicable Forms GST SPL-01, GST SPL-02, GST SPL-03, GST SPL-04, GST SPL-05, GST SPL-06, GST SPL-07 and GST SPL-08 of the CGST Act, 2017

Text of Circular No. 238/32/2024-GST, dated 15.10.2024

Text of Circular No. 248/05/2025-GST, dated 27.03.2025

Text of Instruction No. 02/2025-GST, dated 07.02.2025

Abbreviations

Meaning of Important Legal Maxims