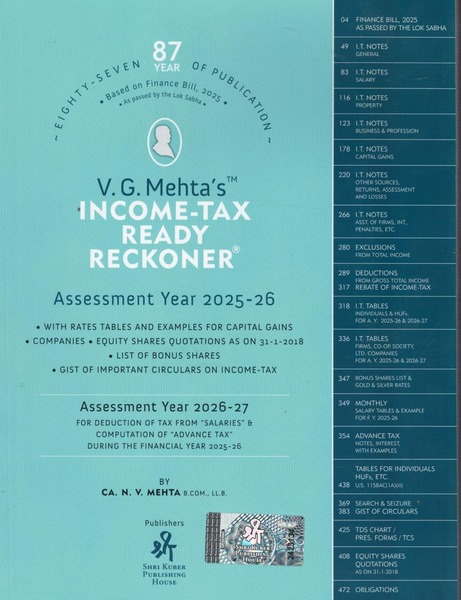

V. G. MEHTA’S INCOME-TAX READY RECKONER 2025-26 WITH The Finance Bill, 2025 As passed by the LOK SABHA BY CA. N. V. MEHTA

Rs 1800/-

87th Edition 2025

(a) The above publication, as usual, contains information & examples for calculation of Income-tax, Surcharge, Addl. S.C., Capital gains, etc.

(b) For the income earned during the assessment years 2025-26 & 2026-27, the Finance Bill, 2025 as passed by the Lok Sabha has made the following changes:

IMPORTANT FEATURES: In relation to assessment years 2025-26 & 2026-27:

1. In the case of all categories of assessees, basic exemption limit and rate structure of I.T. rate of S.C. on I.T. is same as in preceding year, except that in the case of a,domestic company, where the total turnover or gross receipts of a domestic company, in the previous year 2023-24 does not exceed four hundred crore rupees, flat rate of I.T. is 25%, as against 30%. In case of a domestic company opting u/s. 115BAA/115BAB, flat rate of I.T. is 22%/15%, as against 25%/30%. In case of an individual, HUF, AOP, BOI, and artificial juridical person, where the total income: (a) exceeds fifty lakh rupees but does not exceed one crore rupees, rate of S.C on I.T. is 10% as in preceding financial year; (b) exceeds one crore rupees but does not exceed two crore rupees, rate of S.C. on I.T. is 15% as in preceding financial year; (c) exceeds two crore rupees but does not exceed five crore rupees, rate of S.C. on I.T. is 25% as in preceding financial year; and (d) exceeds five crore rupees, rate of S.C. on I.T. is 37% as in preceding financial year. In the case of an association of persons consisting of only companies as its members, rate of surcharge on the amount of income-tax shall not exceed 15% where the total (taxable) income exceeds one crore rupees. In case of firm, local authority and domestic/foreign company, rate of S.C. on I.T. is same as in the preceding year. In case of co-operative society, rate of income-tax: (a) exceeds one crore rupees but does not exceed ten crore rupees, rate of S.C. on I.T. is 7% as in the preceding financial year; and (b) exceeds ten crore rupees, rate of S.C. on I.T. is 12%. Rate of additional S.C. on I.T. and S.C., if any, in respect of all categories of assessees is 4% as in the preceding year.

2. Provisions relating to definition amended/inserted from assessment year 2026-27/1-4-2025 u/s. 2(14)/2(22)/ 2(47A).

3. Exemption provisions amended/inserted from assessment year 2026-27/1-4-2025 u/s.10(4D)/ 10(4E)/10(4F)/10(4H)/10(10D)/10(12BA)/10(23FE)/10(34B)/10(50).

4. Provisions of charitable or religious trust, etc. amended u/s.12AB/13/115UA.

5. Provisions relating to computation of salary income u/s. 17(2).

6. Provision of computation of income from house property substituted u/s. 23(2).

7. Provisions relating to computation of business or professional income amended/inserted u/s. 44BBD/ 115V to 115 VZA.

8. Provisions relating to computation of income from capital gains, amended from assessment year 2026-27 u/s. 2(14)/45(1B)/47/112A.

9. Provisions of carry forward or set-off of accumulated loss, etc. amended u/s. 72A/72AA.

10. Provisions of deduction from gross total income amended from 29-8-2024/ assessment year 2026-27/1-4-2025 u/s. 80CCA/80CCD/80-IAC/80LA.

11. Provisions of rebate of (deduction from) income-tax from assessment year 2026-27 u/s. 87A.

12. Provisions relating to determination of tax in certain cases amended u/s. 115AD/115BAC(1A).

13. Provisions relating to assessment procedure amended/omitted w.e.f. 1-9-2024/1-4-2025/1-4-2025/ assessment year 2026-27 u/s. 132/ 132B/ 158B/ 158BA/ 158BB/ 158BC/ 158BD/ 158BI/ 158BE/ 158BFA/ 139(8A)/ 140B/ 143/ 144BA/ 144(14C)/ 153/ 153A/ 155.

14. Amendment of penalties u/s. 270AA/271AAB/271BB/271C/271CA/271D/271DA/271DB & 271E.

15. Provisions relating to TDS/TCS amended u/s. 193/ 194/ 194A/ 194B/ 194BB/ 194D/ 194G/ 194H/194I/194J/194K/194LA/194LBC/194Q/194S/206AB/206C/206CCA

CONTENTS:

(1) The Finance Bill, 2025 as passed by Lok Sabha.

(2) Notes on important provisions of income-tax, incorporating therein, the amendments made under the Finance Act (No. 2), 2024 & the Finance Bill, 2025 as passed by the Lok Sabha.

(3) Deductions, etc. from gross total income.

(4) Tables &/or examples for individuals, HUFs, associations of persons and non-residents for the assessment years 2025-26 & 2026-27.

(5) Table &/or examples for (i) Firms, (ii) Co-op. Societies and (iii) Ltd. Cos., for the assessment years 2025-26 & 2026-27.

(6) Market quotation for gold & silver. List of bonus shares. Equity shares quotations as on 31-1-2018.

(7) Monthly salary tables for deduction of tax from “Salaries” during the financial year 1-4-2025 to 31-3-2026 with example.