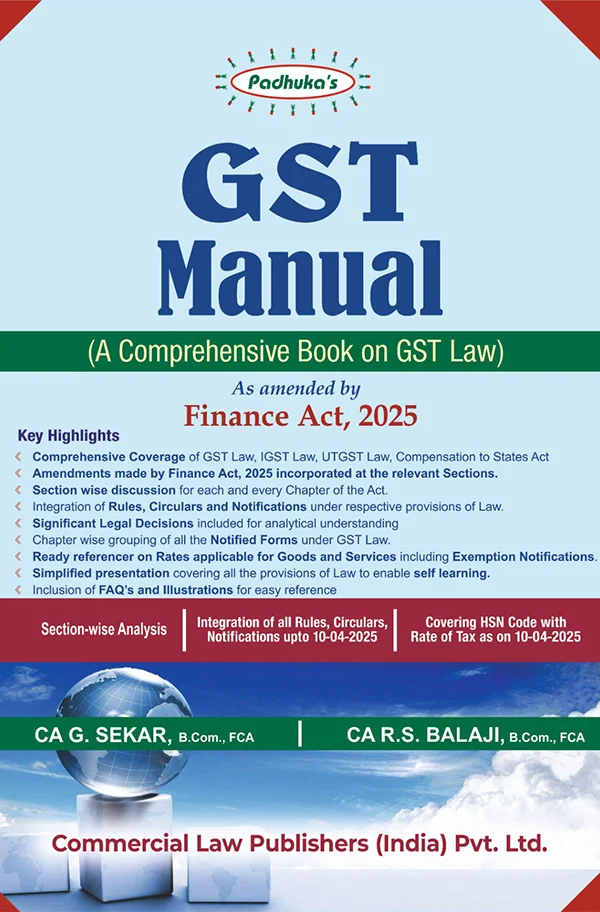

GST Manual (A Comprehensive Book on GST Law) by G. Sekar

Rs 2997/-

6th Edition April 2025

This latest edition of Paduka’s GST Manual, authored by CA G. Sekar and CA R.S. Balaji, offers a comprehensive and authoritative guide to the Goods and Services Tax law, fully updated as per the Finance Act, 2025. Designed for tax practitioners, corporate professionals, students, and academicians, the book presents the entire GST framework in a clear, section-wise analytical format, supplemented with notifications, circulars, and relevant case law.

Key Features include:

<• Complete coverage of the CGST Act, 2017, IGST Act, 2017, UTGST Act, 2017, GST (Compensation to States) Act, 2017, and relevant rules.

<• Amendments brought in by the Finance Act, 2025, clearly highlighted for easy identification.

<• Section-wise presentation of GST provisions with corresponding rules, notifications, and relevant CBIC circulars.

<• Easy-to-read tables for quick reference to rates, exemptions, due dates, and procedural requirements.

<• Detailed explanation of critical concepts such as supply, place of supply, time of supply, input tax credit, registration, returns, assessments, appeals, penalties, and prosecution.

<• Integration of all latest circulars, clarifications, and notifications issued up to 10-04-2025.

<• Includes recent case law and practical illustrations to aid real-world application.